Welcome back to 2025 Trends. This week’s stories show how quickly culture and consumer behavior can swing – looking at data released over the last couple weeks. Here’s an executive summary:

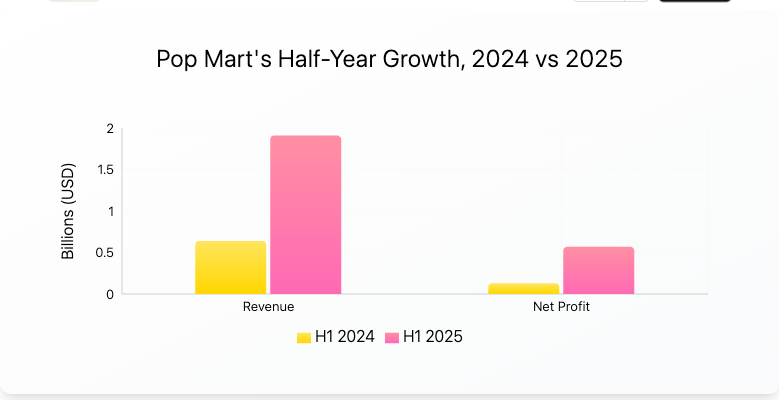

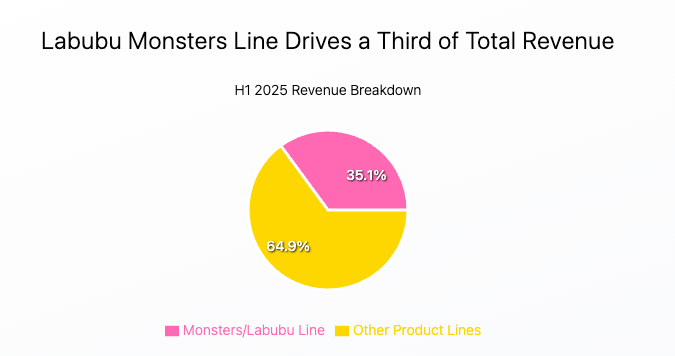

- Labubu explodes into a global brand. Pop Mart reports revenue up 204% and profits nearly 400% in H1 2025, with Labubu driving more than a third of sales.

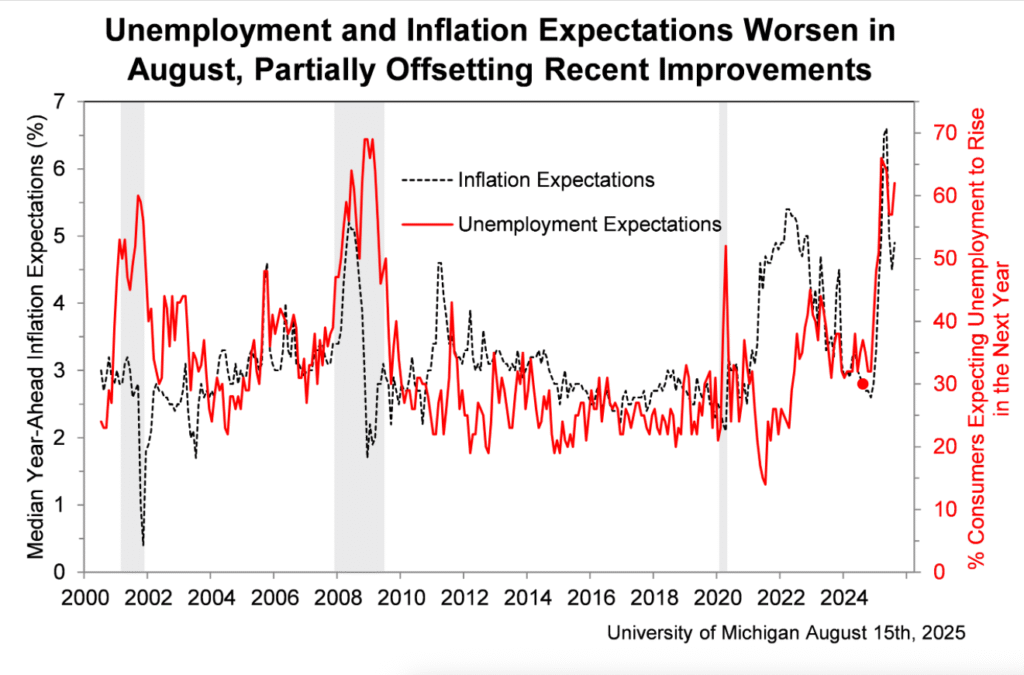

- Consumer sentiment weakens. The University of Michigan index dropped to 58.6 in August, while one-year inflation expectations climbed to 4.9%.

- Pumpkin spice season arrives early. Instacart shows peak demand came 10 days earlier in 2024 than 2023, with creamers up 1,459% and West Virginia leading the nation.

- GPT-5 flops on launch. Daily active ChatGPT users fell 8% week-over-week, Reddit logged 12,000 downgrade complaints in the first week, and subscriber churn rose an estimated 5 points.

Labubu keeps climbing

If you haven’t come across Labubu yet, here’s what you need to know. Labubu is a small rabbit-like figurine with sharp teeth and oversized eyes. Kind of like a new take on Ferbies from back in the 90s. But it’s a pretty expensive product doing surprisingly well while most people are cutting their spending from inflation.

It comes from Pop Mart, a Chinese company that has found success making blind-box collectibles (where buyers don’t know which figure they’re getting until they open the box).

Labubu’s funny faces make it go viral on social media, which is ultimately what’s driving it to be the hottest selling product globally right now. It keeps going viral, mostly among younger audiences, because it is constantly memed on social media. Videos of Labubu looking happy, angry, or devastated have racked up millions of views on TikTok and Weibo.

Enough about the toy, the revenue numbers are shocking. Last week’s release showed Pop Mart’s half-year earnings are up 204 percent year over year and profit nearly 400 percent higher. The “Monsters” line, which features Labubu, accounted for $670 million in sales, which is over a third of the company’s total. Knockoffs are flooding markets in Europe and North America, and it’s become so viral that there are even people “satirically worshipping” the doll like it is a religious idol.

For CPG leaders, Labubu is an example of how a social-media first product can make an item that’s very inexpensive to produce into a luxury with a high price tag. Scarcity, cultural humor, and emotional resonance turned Labubu into a billion-dollar brand in months. No licensed characters or heavy ads. Just a focus on “influencers” that was done really well.

Consumer mood is turning cautious

The latest economic data shows that people are increasingly worried about rising costs even if their paychecks are holding steady.

On August 15, the University of Michigan’s consumer sentiment index came in at 58.6, a drop of five percent from July and the first decline after four straight months of gains. Inflation expectations for the year ahead rose to 4.9 percent, up from 4.5 percent last month.

One piece of the puzzle is inflation. The same survey found that Americans now expect prices to rise 4.9 percent over the next year, up from 4.5 percent in July. Longer-term inflation expectations held steady around 3 percent, which is still above the Federal Reserve’s 2 percent target.

These expectations matter because they influence behavior. If people think groceries and gas will keep climbing, they adjust by trading down, cutting back, or delaying discretionary purchases.

Income levels tell a divided story. High-income households are still spending, especially on travel and premium experiences. July retail data showed households earning more than $100,000 increased spending by nearly 5 percent month-over-month. By contrast, middle- and lower-income groups are holding back. Restaurant sales fell in July, while grocery sales rose modestly, which signals more meals are being eaten at home. Families are looking for control and predictability in their budgets.

The sentiment drop also comes as new tariffs on imports add pressure to prices. Consumers are seeing headlines about higher costs on electronics, apparel, and household goods. Even if the impact hasn’t fully hit their wallets yet, the anticipation is enough to create caution.

This data matches what’s reported in retail sales numbers. July sales showed grocery stores climbing modestly while restaurants fell. People are signaling that they want to keep a closer eye on their wallets and confidence is shaky.

For CPG companies, the message is straightforward. People are still shopping, but they’re doing it with more hesitation. Brands that emphasize value, consistency, and trust will fare better in this environment than those that lead with novelty or luxury. Promotions, multipacks, and everyday-low-price messaging are likely to resonate. It’s not a collapse in confidence, but it’s a warning sign that households are shifting into defense mode.

Pumpkin spice creeps earlier

Instacart released new data yesterday confirming that pumpkin spice season is creeping forward again. In 2024, the peak week for pumpkin spice orders hit on September 17, which was 10 days earlier than 2023. Demand then dropped quickly by the end of September, before spiking again around Thanksgiving.

It’s not just a latte game, too. The fastest-growing pumpkin spice categories in 2024 included yogurts, waffles, air fresheners, and even baby food. Even in coffee, pumpkin spice expanded outside the Starbucks menu. For example, Instacart reported that Pumpkin spice creamers sell 1,459 percent more in fall compared to the rest of the year. While Coffee Mate and International Delight dominate, health-minded brands like nutpods and Laird Superfood are emerging market leaders.

What’s really fascinating – how different pumpkin spice preferences are based on where you live in the US. For example, West Virginia is the most pumpkin-spice obsessed state. They order 91 percent more pumpkin spice items than other states’ averages. Pennsylvania and Oklahoma follow closely, while Hawaii orders 63 percent less than average, making it the least pumpkin-spicy state.

When it comes to creamer, Hawaii and Alaska prefer coconut, the Carolinas and Virginia go for sweet cream, and Massachusetts loves coffee cake.

From coffee to air fresheners, pumpkin spice is a seasonal staple that signals fall for millions of households. It shows how limited-time seasonal flavors can consistently drive urgency, loyalty, and repeat behavior.

GPT-5 is a big flop

OpenAI’s newest flagship, GPT-5, landed this month and the reception has been rough. Within the first week, more than 12,000 Reddit posts mentioned a “GPT-5 downgrade,” and traffic data shows daily active users on ChatGPT’s site fell 8 percent compared with the week before launch. The rollout was supposed to mark a leap forward but has instead been framed as a step back.

Personally, I’ve struggled to get the same quality from GPT-5 that I relied on in the past. Frustratingly, OpenAI removed access to the older models (except a faster but less accurate one), so unless you are working directly with the API you are locked into GPT-5.

Most complaints focus on the slow response time or weaker personality. I don’t find those particularly important or noticeable. My issues have been worse accuracy and worse quality from ChatGPT – though I’m not experiencing this through their API, which is curious.

It often feels like the model drifts away from instructions or gives generic answers that ignore my instructions. I don’t mind waiting for a strong response, but right now the quality is a bigger issue that’s causing me to lean more heavily on Anthropic’s Claude when running quick questions through a “Chat interface.”

5 percent of users churned after the launch. OpenAI admitted the rollout was rocky. Sam Altman described the launch as “bumpy” and GPT-4o was temporarily re-enabled for Plus subscribers. But GPT-4o was never the flagship model. It was designed as a lightweight option for fast, simple tasks. The more powerful lines, like the o3 family, have been discontinued altogether.

The irony is that on benchmarks GPT-5 looks stronger than its predecessors, yet the everyday experience feels worse. That gap between lab performance and real-world interaction is why so many users are frustrated. What people want is not just accuracy but a system that feels responsive, reliable, and human. Until GPT-5 finds its footing, it risks being remembered less as a breakthrough and more as a reminder that bigger is not always better.

What complicates the story is that GPT-5 is not a single model but a system that routes queries between smaller “instant” engines and a heavier “reasoning” engine. During the first 72 hours of launch, routing errors reportedly spiked by over 40 percent, which meant many users saw weaker, shorter answers than expected.

Subscriber sentiment data mirrors the backlash. A TechRadar survey of ChatGPT Plus users found that 67 percent felt GPT-5 produced “less engaging” text than GPT-4o and 42 percent said they considered canceling their subscription. The new “thinking mode,” capped at 200 messages per week, was flagged as a top frustration.

Despite this, performance benchmarks show GPT-5 is stronger on paper. On reasoning benchmarks, early test scores were 4 to 6 points higher than GPT-4o. But those improvements have been overshadowed by perception. Bill Gates even remarked last week that GPT-5 looked like a plateau moment for AI progress rather than the leap many expected.

Closing

That’s it for this week’s 2025 Trends. Labubu shows how a strange little collectible can go viral and turn into serious business. The latest consumer sentiment numbers tell us families are still spending but with more hesitation. Pumpkin spice reminds us that seasonal rituals keep shaping habits in a very real way. Lastly, the GPT-5 launch proves that even the most hyped technology can stumble if the experience does not feel right.

The thread running through all of these stories is simple. People want products that feel personal, timely, and trustworthy. When a brand delivers that, it has a chance to turn curiosity into loyalty.