While tourism and alcohol consumption decline, online gambling, or iGaming, is moving in the opposite direction. Perhaps money being saved by not buying alcohol is being wagered in this burgeoning market. August 2025 results set records across major iGaming states. Pennsylvania generated $291 million. New Jersey posted $248 million, its highest month ever. Michigan recorded more than $300 million when online sports betting is included. Combined, these three states pulled in nearly $750 million in just one month.

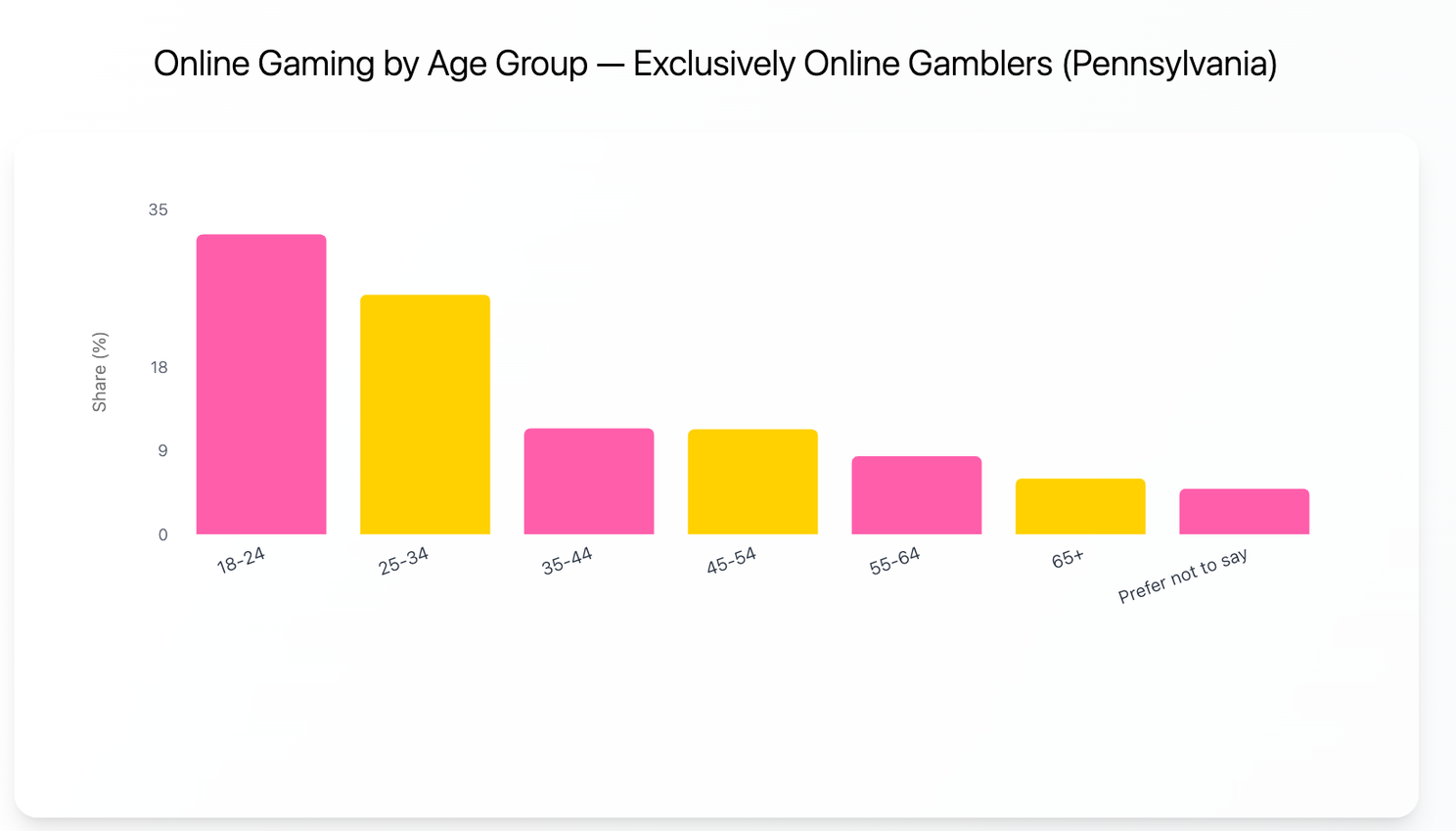

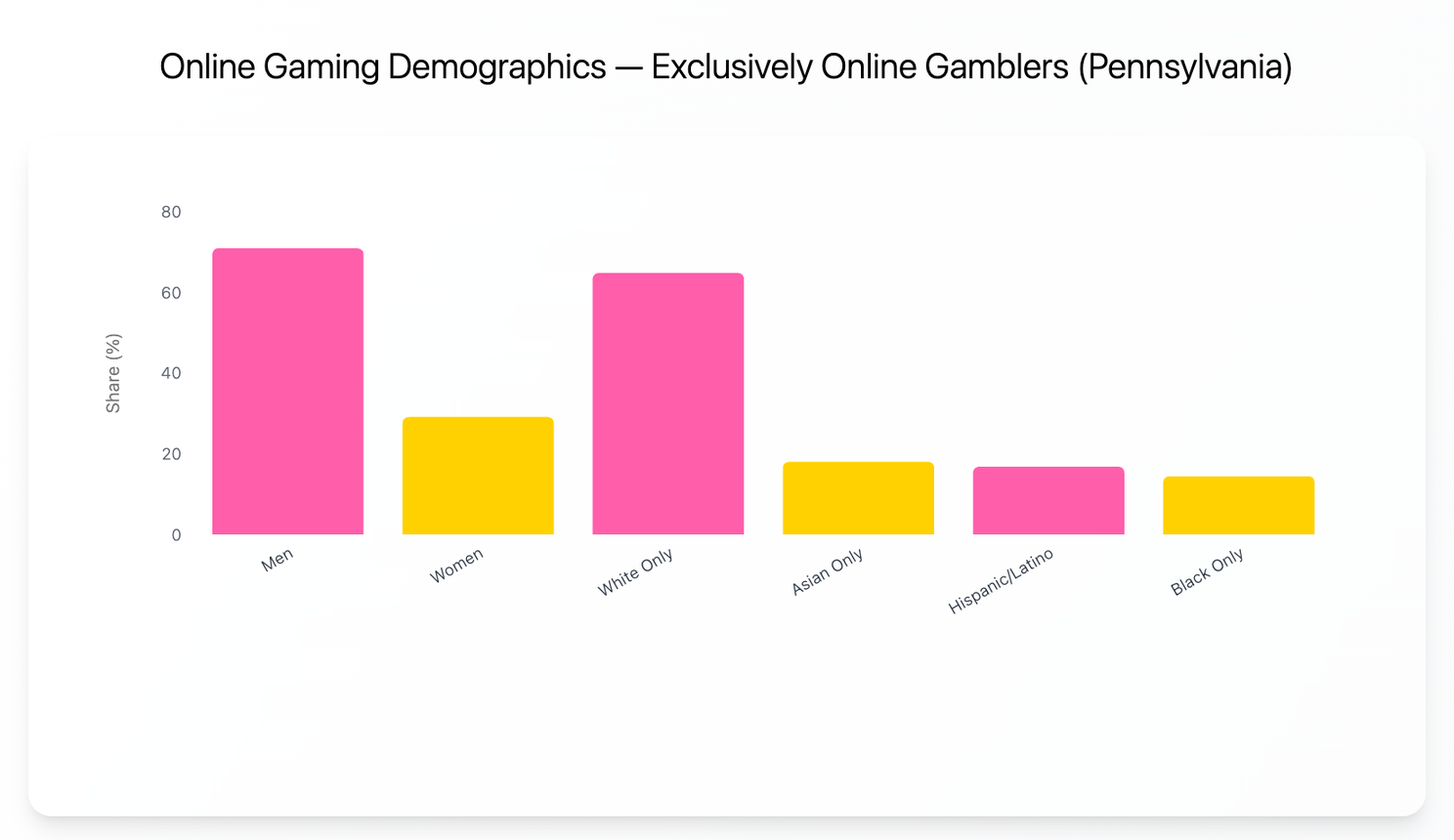

The profile of online gamblers is clear. About 70 percent are men and age skews young. One third of players are between 18 and 24 and another quarter are 25 to 34. That makes online gaming one of the youngest consumer markets in the U.S.

Diversity is higher than in traditional casinos. Black, Asian, and Hispanic players are more represented in online platforms than in land-based venues. This shows that digital access is pulling in groups that have been underrepresented in physical casinos.

Slots dominate revenue. In Pennsylvania, online slots alone generated $179 million in August. Table games added nearly $50 million, while online poker produced a smaller $2.5 million. Sports betting adds another dimension, with New York recording more than $2 billion in mobile handle in the same month.

The rise of online gaming is striking because it coincides with pullbacks in other leisure categories. Younger adults may be drinking less and traveling less but they are spending heavily on digital gambling. For states, it brings a growing source of tax revenue. For operators, it offers access to customers who might never walk into a casino. For public health groups, it raises concerns about addiction among younger men who are the heaviest users.

As October begins, the outlook for online gaming is strong. More states are debating legalization and technology is making platforms more user friendly. The trend suggests continued growth, though balancing that with responsible play will be a pressing challenge.