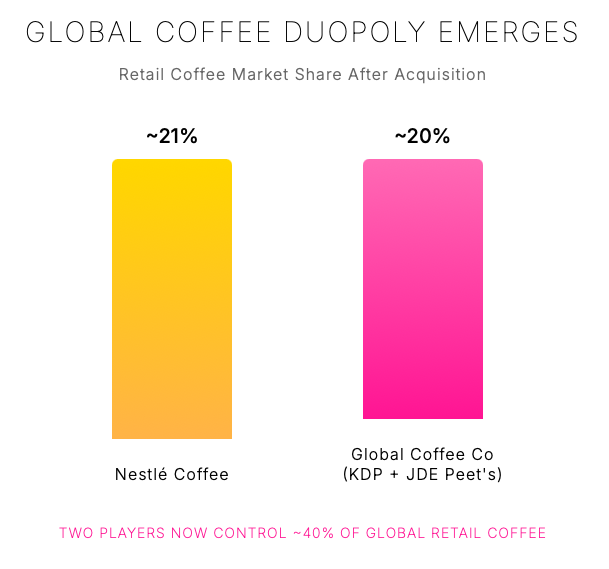

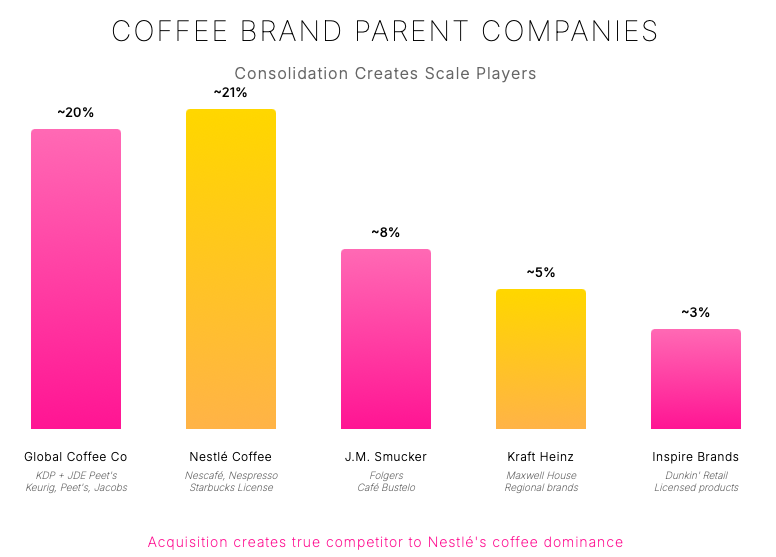

Keurig Dr Pepper buying JDE Peet’s concentrates power at the top of retail coffee. Two groups now sit on roughly forty percent of global coffee sold at retail. That reshapes buyer negotiations, trade terms, and how quickly new formats go national.

Why the timing makes sense

Coffee input costs spiked and U.S. tariffs hit Brazilian imports. When volatility rises, breadth of origins and logistics muscle become the advantage worth paying for. A rich premium and higher leverage only work if procurement wins, supply optionality, and shared platforms convert to savings fast.

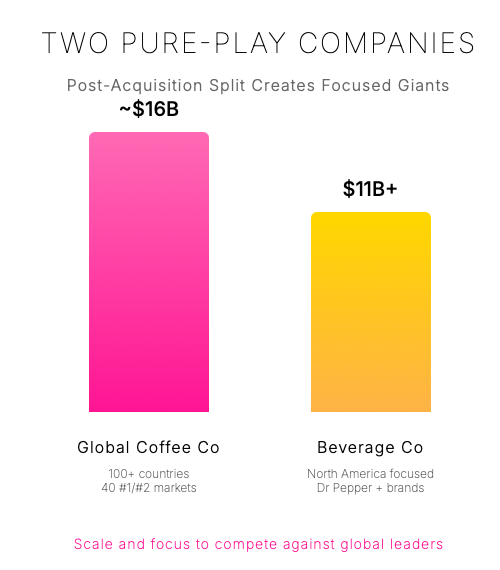

What the new structure enables

The post-deal split creates two pure plays. Global Coffee Co runs a worldwide portfolio with sourcing depth and brand breadth. Beverage Co stays a North America engine built for velocity and trade execution. Clear lanes speed decisions, remove portfolio compromises, and make capital allocation cleaner.

How the platforms click together

Keurig brings installed households and a direct-to-consumer spine with subscriptions and loyalty. JDE Peet’s brings scale in more than one hundred countries and deep retailer relationships. Together the portfolio can place pods, beans, instant, ready-to-drink, and café experiences in a tighter grid with fewer white spaces for rivals.

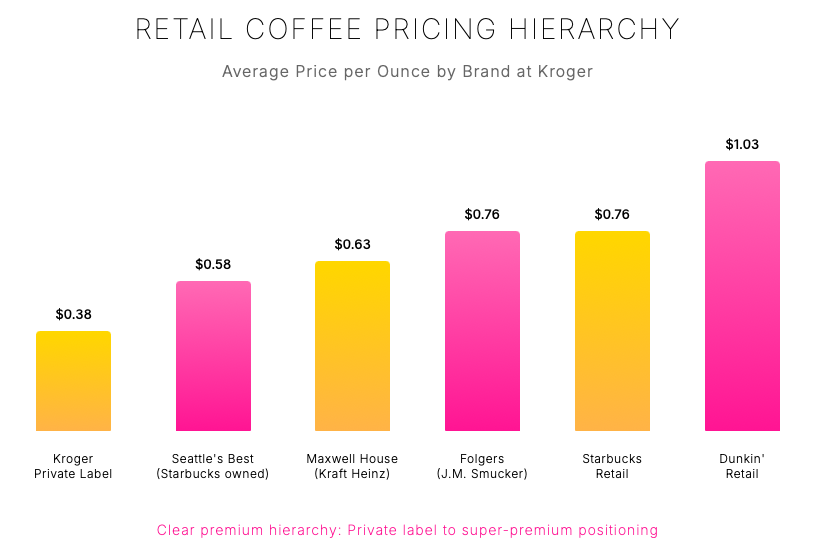

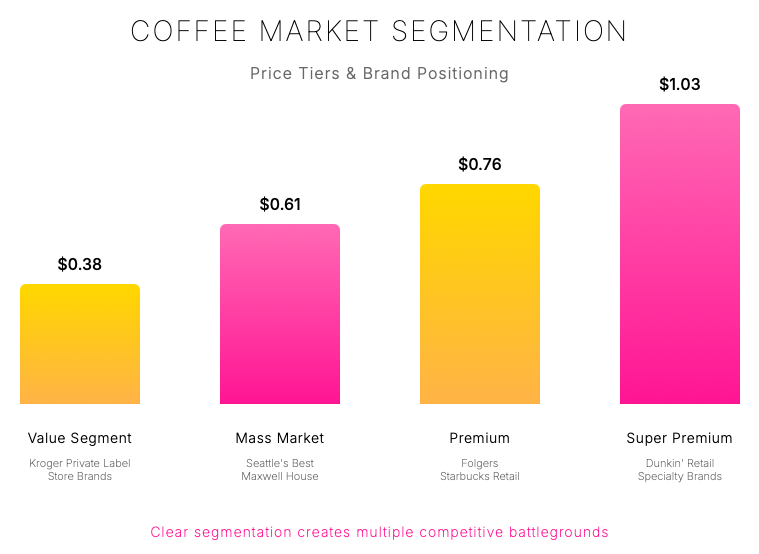

Price ladders still decide margin

Entry price points keep the cart full, but mix and profit come from moving shoppers one rung up the ladder. Use targeted promotions, small pack trade-ups, grind upgrades, and seasonal flavors to lift average price without losing base volume.

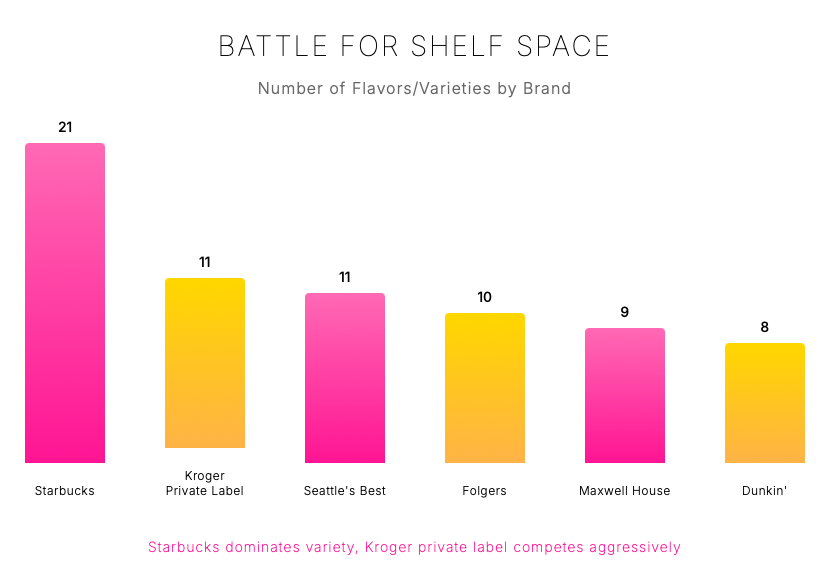

Shelf is the battleground

Attention follows variety. Leaders win space with breadth and limited runs while private label and legacy cans defend the middle with value. To earn facings without margin drag, deploy discovery packs, seasonal rotations, cold-forward displays, and store clusters tied to local weather and dayparts.

Design for missions, not just brands

Value and mass tiers win pantry refills. Premium and super premium win gifts, seasonal drops, and iced occasions. Match pack sizes, flavor sets, and channels to each mission to raise mix without blowback on price-sensitive baskets.

Where the pressure lands

With two giants at the top, mid-tier players feel more strain on procurement, media, and shelf fees. Expect faster rollouts across pods, beans, instant, and RTD as Keurig households meet JDE Peet’s global reach. Expect more deals as others seek scale or distinctiveness.

Fast paths to distinctiveness

Partnerships and tuck-ins can add energy and reach faster than building from scratch. Good candidates bring community, formats, or brand heat that travel well across channels.

- Philz Coffee noted for made-to-order blends and also poured on Virgin Atlantic.

- Dutch Bros Coffee with strong drive-thru culture and flavor innovation.

- Gloria Jeans Coffee with global franchise reach.

- Death Wish Coffee with a clear strength message and cult following.

Playbook for brands and retailers

- Lock alternative origin supply and contract optionality for the next crop cycle.

- Build a laddered promo plan that trades shoppers up one rung without losing entry price shoppers.

- Use discovery packs and seasonal flavors to win premium facings, especially in cold and on-the-go sets.

- Tie assortment to missions by store cluster, not a single national plan.

- Leverage DTC subscriptions and retailer media to shorten the test-and-learn loop on flavors and formats.

FAQ

Is coffee now a duopoly

At retail, two groups now account for about forty percent worldwide. That does not end competition, but it concentrates bargaining power and accelerates national launches.

Will prices keep rising

Prices depend on harvests and trade policy. Scale players can soften shocks through origin mix and contracts, which is a core reason this deal happened.

What changes for premium brands

Premium and super premium remain the profit engines. Expect more curated discovery packs, seasonal drops, and cold formats to keep mix moving up.

What should private label do

Anchor opening price points and add two or three on-trend flavors to defend the middle. Use value-plus packs and cold brew to hold younger baskets.

Where will innovation show up first

Single-serve pods and ready-to-drink lines move fastest, followed by instant upgrades and café tie-ins that create halo effects in grocery.