If you like this article, check out my company Simporter.

Executive Summary

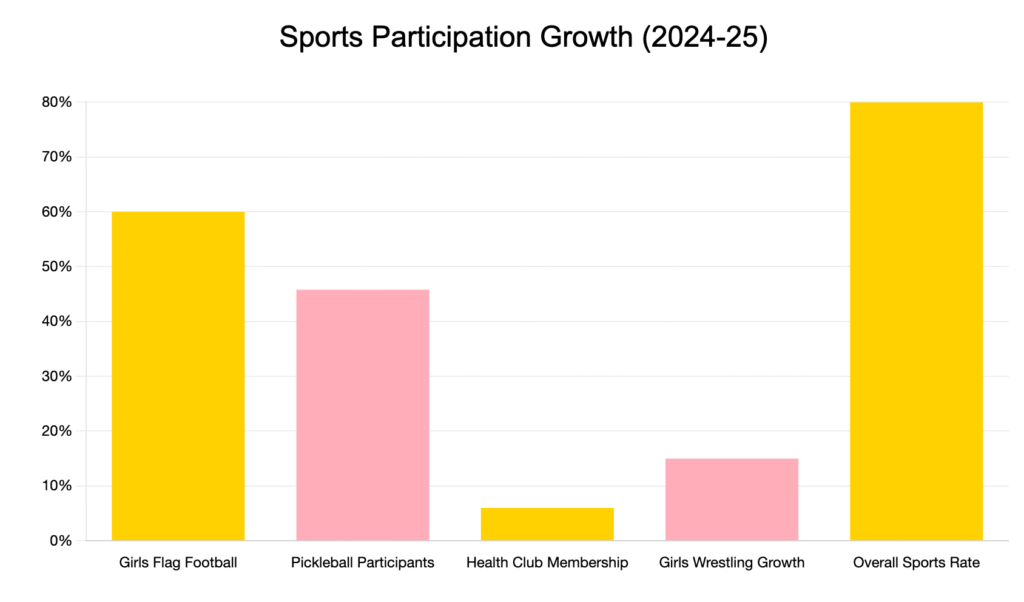

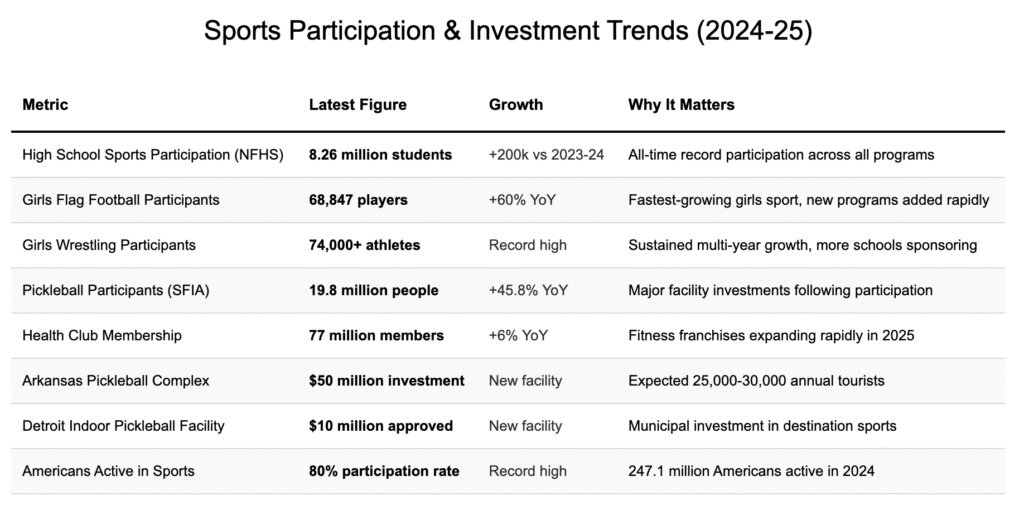

- Sports participation hits all-time highs with 8.26 million high school athletes in 2024-25, driven by explosive growth in girls’ sports (flag football +60%, wrestling record highs) and $70+ million in new pickleball infrastructure investments

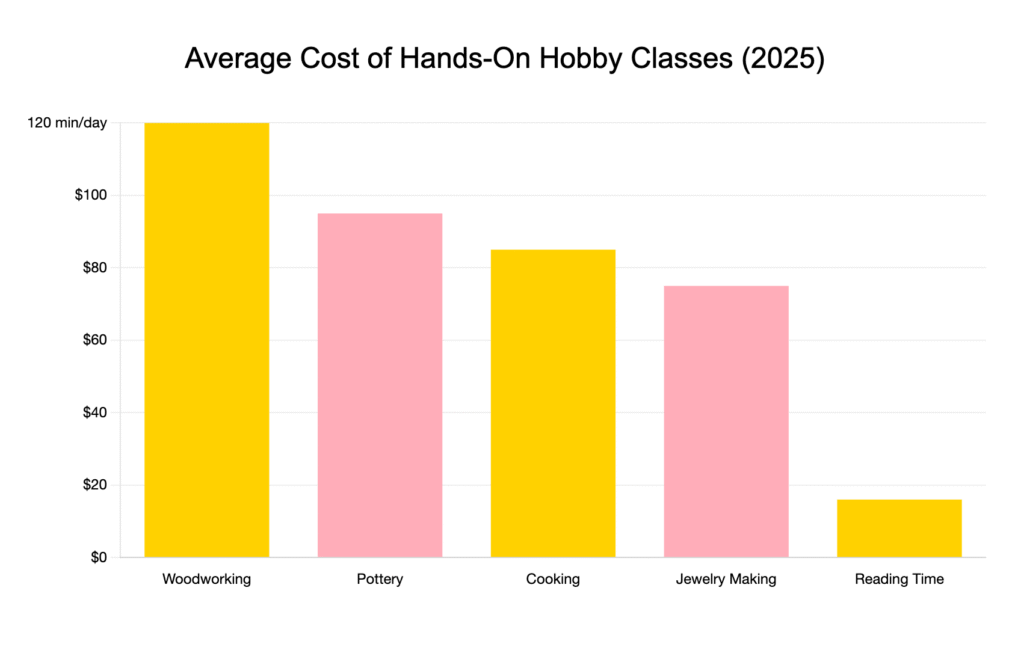

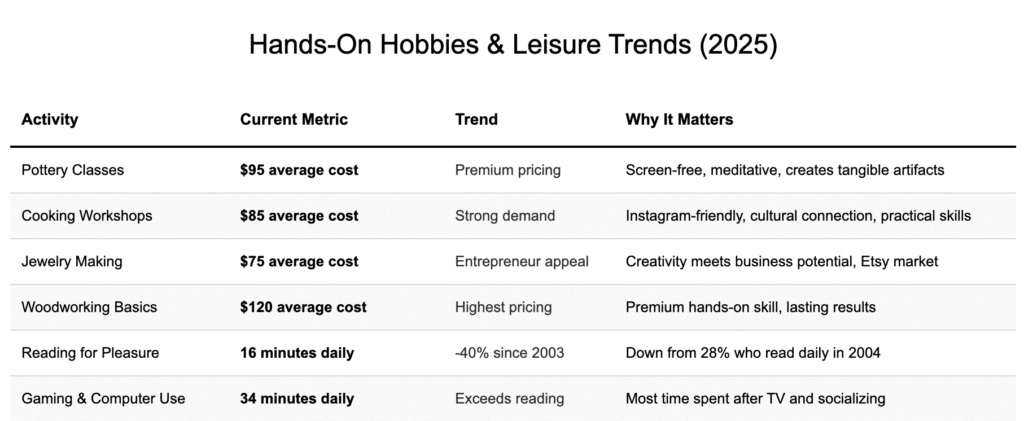

- Hands-on hobby classes command premium pricing as Americans pay $75-120 per session for pottery, cooking, and jewelry making while reading for pleasure continues 20-year decline to just 16 minutes daily

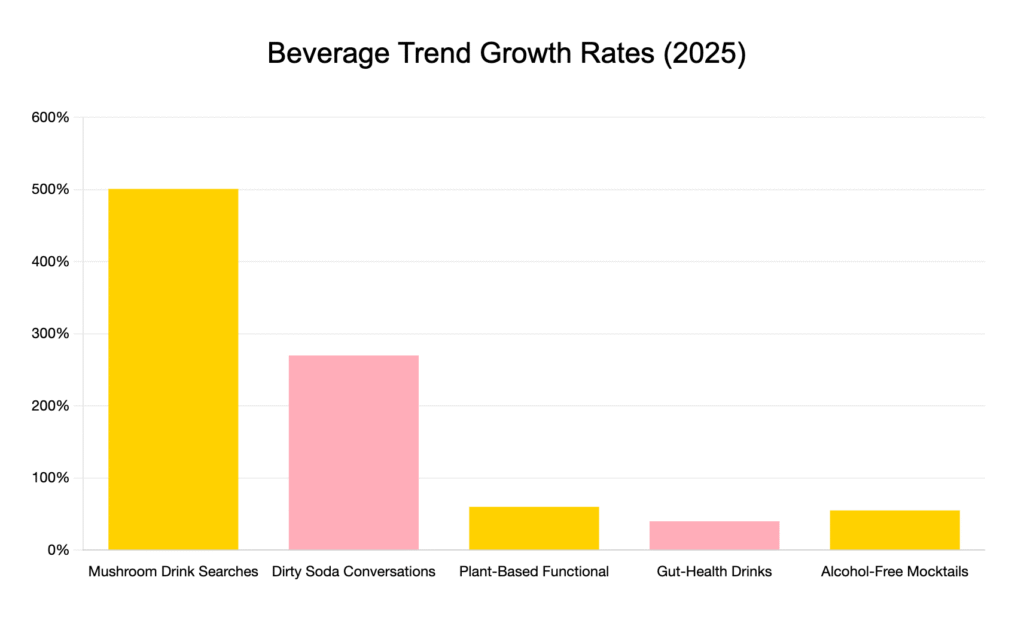

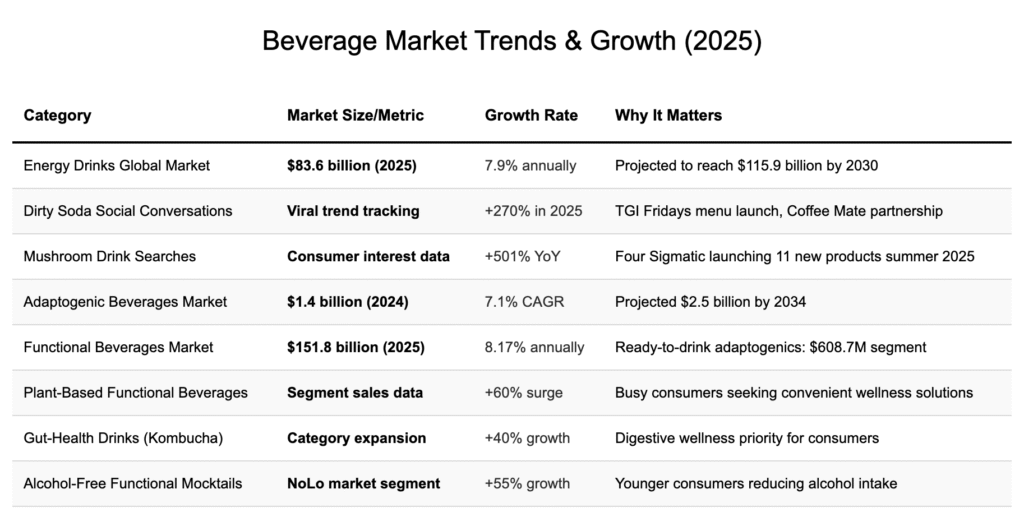

- Beverage industry transforms around functionality with mushroom drink searches up 501%, dirty soda conversations growing 270%, and the global functional beverage market reaching $151.8 billion as consumers prioritize performance over taste

- Investment dollars follow participation trends with fitness franchises planning 250+ new locations in 2025, private equity acquiring major chains, and municipalities funding sports facilities as destination entertainment

- Cultural shift from consumption to creation evident across all three sectors, with Americans choosing activities that build skills, produce tangible results, and provide social connection over passive digital entertainment

Welcome to the 10th edition of Trend Newsletter, where we track the data behind what Americans are actually doing with their time and money. Every two weeks, we cut through the noise to identify genuine behavioral shifts backed by real numbers, not just buzz.

Trending Sports

American sports participation just shattered records. High school athletics reached 8.26 million students in the 2024-25 school year, adding nearly 200,000 participants from the previous year.

The biggest driver? Girls’ sports are absolutely exploding.

Flag football tells us a lot more than I expected before I dove in. The latest numbers show almost 70,000 participants in 2024-25, thanks to a massive 60% year-over-year increase.

Think about how quickly the adoption curve happened for girls’ flag football. Just five years ago, it barely existed as an organized high school sport. Today, it’s the fastest-growing segment in all of high school sports.

Girls’ wrestling follows a similar trajectory. With over 74,000 participants in 2024-25, it represents sustained multi-year growth as more schools sponsor teams. This isn’t just about girls wanting to wrestle. It’s about institutions finally making those sports available, the interest has existed for years.

Schools are responding to years of ignored student interest. Many districts are simply catching up to what girls have been asking for. Young women are also increasingly rejecting the idea that certain sports “aren’t for them.” Social media has amplified female athletes’ visibility, creating role models that previous generations lacked.

Across both genders, pickleball continues to grow. Last year – it grew almost 50% compared to the year before – now boasting 19.8 million participants. Plus, serious money is following this growth.

Major facility investments are pouring in throughout 2025. Arkansas is developing a $50 million pickleball complex hoping to attract as much as 30,000 tourists per year. Detroit approved a $10 million indoor facility and Seattle allocated $2.1 million for pickleball courts.

Local governments are looking at pickleball as a potential new cultural icon.

Outside of pickleball, people continue to become more athletic. Health club membership grew to 77 million last year, a 6% year-over-year increase. Even more, Americans reached a record 80% participation rate in at least one physical activity.

Planet Fitness expects 160-170 new gyms. Crunch Fitness plans 90+ new locations. People want to exercise more and the gym chains are expanding. Both of those gyms, by the way, had big private equity moves. Leonard Green & Partners acquired Crunch Fitness earlier this year. Multiple PE firms made significant investments in Planet Fitness franchisee platforms.

The numbers tell us that American sports participation is breaking records. The investment dollars tell us this trend has serious staying power.

Trending Hobbies

Hobbies are going premium despite inflation. People are paying significant money to learn hands-on skills that their grandparents knew by heart.

Since as “far back” as Covid, we’ve seen people trying harder than ever to get out of the home and socialize. Hobbies are one of the ways people are doing that, especially now that alcohol consumption is down. People are spending time after work learning how to make a pot, how to paint, cook, or even make jewelry.

But with inflation, these aren’t cheap hobbies. Pottery classes average $95 per session. Cooking workshops cost $85. Jewelry making runs $75. Woodworking basics command $120. Depending where you live, too. In many cities, those prices seem like bargains.

But Americans are using these activities – not just to build things needed around the house. They’re using them as an alternative to screens and gives you an experience that’s meditative, screen-free, and produces something tangible at the end.

It is still digital though. If you look at the hobbies we listed, they’re all very “Instagrammable.” The Instagram flex has infiltrated personal hobbies and now people are taking up more aesthetic hobbies, which give them perfect moments to capture and share online.

The exception there is probably cooking. Fresh pasta actually tastes better than dried pasta so participants aren’t just learning for aesthetics. These classes connect people to cultural traditions in an era when many feel disconnected from their heritage. It gives you a practical, social way to learn something new.

The contrast with declining leisure activities is stark. Reading for pleasure has dropped 40% since 2003, according to 2025 research using Bureau of Labor Statistics data. The figure dropped from 28% who read daily in 2004 to just 16% a couple years ago. Americans now spend only 16 minutes daily reading for personal interest.

Gaming and computer use for leisure now averages 34 minutes per day. Reading requires imagination to visualize scenes and characters. Gaming and videos provide that visualization automatically.

But the hands-on hobby growth means it’s not just about digital. People are ready to learn new skills outside the home, especially if it is social and/or gives them something to take home at the end of the day.

This trend suggests Americans are craving authentic, meaningful experiences that counterbalance digital overwhelm. The hobbies gaining popularity share common characteristics. They’re social, skill-building, screen-free, and produce tangible results.

As more people discover the satisfaction of creating rather than consuming, the hands-on hobby trend is likely to expand into new areas of craft mastery and practical skills.

Beverage Trends

Walk into any restaurant this fall and you’ll see menu items that weren’t on anyone’s radar six months ago. These are three unexpected trends that have reshaped what Americans are drinking between May and September 2025.

Dirty Soda Goes Corporate (And Hits 270% Growth)

The biggest surprise of summer 2025 wasn’t a new energy drink or wellness shot. It was dirty soda, a trend that exploded from Utah Mormon culture to mainstream restaurant chains in just months.

Social media conversations around dirty soda surged 270% this year, according to industry tracking data. What started as TikTok videos combining Dr Pepper with coconut coffee creamer has become serious business.

TGI Fridays launched an entire dirty soda menu this summer, featuring drinks like Cherry Cream Cola and Strawberry SZN starting at $3.99. The timing shows how quickly major brands are adapting to viral trends.

Coffee Mate made the boldest move, partnering with Dr Pepper to create a Coconut Lime Flavored Creamer specifically designed for dirty sodas. The product returned for summer 2025 after selling out in 2024, now available at Target and Kroger in 32-ounce containers for $4.49.

The trend appeals especially to Gen Z and Millennials seeking customizable, Instagram-worthy drinks that combine nostalgia with personalization. Major soda brands are responding with specialized products rather than fighting the modification of their core offerings.

Mushroom Beverages Hit $1.4 Billion (With 501% Search Growth)

Perhaps the most unexpected winner of 2025 is mushroom-infused beverages. The adaptogenic drinks market reached $1.4 billion in 2024 and is projected to hit $2.5 billion by 2034, growing at 7.1% annually.

Searches for “mushroom drink” are up 500% year-over-year, driven by consumers seeking natural stress relief and cognitive enhancement without pharmaceutical side effects.

Four Sigmatic is preparing to launch 11 new products by summer 2025, expanding beyond mushroom coffee into instant teas, protein powders, and elixirs infused with lion’s mane, reishi, and chaga. Their organic instant tea line targets specific functions like focus, calm, mood, and immune support.

GT’s Living Foods launched ALIVE, a sparkling adaptogenic beverage with reishi, chaga, and turkey tail mushrooms. The product represents how the trend has moved beyond expected coffee categories into mainstream sparkling beverages.

The appeal lies in functionality without the crash associated with caffeine or alcohol. Consumers want beverages that provide measurable benefits for stress, sleep, and cognitive function, backed by centuries of traditional medicine use.

The $151.8 Billion Functional Beverage Surge

The broader functional beverage market hit $152 billion in 2025, growing at 8% annually as Americans prioritize beverages that serve specific purposes beyond hydration.

Recent launches show how established brands are adapting. PepsiCo introduced adaptogenic energy drinks under the Rockstar brand, featuring ginseng and rhodiola for focus and stamina. Coca-Cola launched functional waters under Smartwater with electrolytes and vitamins for mental clarity.

The trend extends beyond traditional wellness categories. Ready-to-drink adaptogenic beverages now account for 44.2% of the adaptogenic market, valued at $608.7 million, as busy consumers seek convenient wellness solutions.

Plant-based functional beverages saw a 60% sales surge, while gut-health drinks like kombucha expanded 40%. The demand for alcohol-free functional mocktails grew 55% as younger consumers reduce alcohol intake.

Brands are responding with sophisticated formulations. Rebbl launched ready-to-drink adaptogenic protein shakes blending ashwagandha and maca for the fitness segment. These products combine multiple health benefits in single servings.

What connects these trends

The common thread across all three trends is functionality meeting experience. Americans want beverages that not only taste good and photograph well but also provide measurable benefits for energy, stress relief, or cognitive enhancement.

Unlike previous beverage trends driven by marketing campaigns, these movements emerged organically through social media and consumer experimentation. Brands are following rather than leading, scrambling to create products for trends that gained momentum without corporate involvement.

The speed of adoption suggests a fundamental shift in how beverage trends develop and scale. Social media has compressed the timeline from viral content to retail products, forcing established brands to become more agile and responsive to consumer-driven movements.

This represents a new era where beverage companies must monitor cultural trends as closely as sales data, adapting quickly to maintain relevance with increasingly empowered consumers who drive their own product innovation.

Closing

The common thread across sports, hobbies, and beverages is functionality meeting experience. Americans are voting with their wallets for products and activities that serve specific purposes beyond basic enjoyment, signaling a broader cultural realignment toward intentional consumption and skill-building.

Next edition publishes September 30th, examining retail, technology, and travel trend data from Q3 2025.

Works Cited

“2025 Trends Shaping the Beverage Industry.” Publicis Sapient, 9 Apr. 2025, publicissapient.com/insights/beverage-industry-trends.

“Adaptogenic Beverages Market: Emerging Trends | CAGR of 7.1%.” Market.us, Aug. 2025, news.market.us/adaptogenic-beverages-market-news.

“Adaptogenic Beverages Market Size, Statistics Report 2034.” GM Insights, 1 Feb. 2025, gminsights.com/industry-analysis/adaptogenic-beverages-market.

“‘Bold’ New Dirty Soda Drink Menu Launches at International Restaurant Chain.” Parade, 15 July 2025, parade.com/food/tgi-friday-new-dirty-soda-drink-menu-summer-2025.

Bone, Jessica K., et al. “The decline in reading for pleasure over 20 years of the American Time Use Survey.” iScience, Aug. 2025, cell.com/iscience/fulltext/S2589-0042(25)01549-4.

“Coffee Mate Brings Back Popular Dr Pepper Collab This Summer.” Parade, 1 May 2025, parade.com/food/coffee-mate-coconut-lime-dr-pepper-dirty-soda-creamer-flavor-returns-stores-summer-2025.

Della Rosa, Jeff. “Springdale pickleball project on track for spring groundbreaking.” Talk Business & Politics, 30 Jan. 2025, talkbusiness.net/2025/01/springdale-pickleball-project-on-track-for-spring-groundbreaking.

“Functional Beverages Market – Size, Growth, Industry Trends & Analysis.” Mordor Intelligence, 2025, mordorintelligence.com/industry-reports/functional-beverage-market.

“Lenders, Private Equity Lean Further Into Fitness Franchises.” Franchise Times, 28 May 2025, franchisetimes.com/franchise_finance/lenders-private-equity-lean-further-into-fitness-franchises.

“Multi-unit Franchisees Pump Up Planet Fitness.” Franchise Times, Sept. 2025, franchisetimes.com/franchise_times_cover_stories/multi-unit-franchisees-pump-up-planet-fitness.

National Federation of State High School Associations. “Participation in High School Sports Hits Record High with Sizable Increase in 2024-25.” NFHS, 18 Aug. 2025, nfhs.org/stories/participation-in-high-school-sports-hits-record-high-with-sizable-increase-in-2024-25.

“New $10 million indoor pickleball facility proposed in Metro Detroit.” ClickOnDetroit, 2 Sept. 2025, clickondetroit.com/news/local/2025/09/02/new-10-million-indoor-pickleball-facility-proposed-in-metro-detroit.

“Soda is making a comeback.” CNN Business, 1 Nov. 2024, cnn.com/2024/11/01/business/coke-dr-pepper-soda/index.html.

Sports & Fitness Industry Association. “SFIA’s Topline Report Shows 247.1 Million Americans Were Active in 2024.” SFIA, 26 Feb. 2025, sfia.org/resources/sfias-topline-participation-report-shows-247-1-million-americans-were-active-in-2024.

“The Rise of Dirty Soda: A Trend Taking the Beverage Industry by Storm.” The Food Institute, Sept. 2025, foodinstitute.com/focus/the-rise-of-dirty-soda-a-trend-taking-the-beverage-industry-by-storm.

“US Beverage Trends August 2025 Report.” Simporter, 25 July 2025, simporter.com/beverage-trends-in-the-us.

“US Functional Beverage Market Insights for 2025.” Glanbia Nutritionals, 4 Dec. 2024, glanbianutritionals.com/en/nutri-knowledge-center/insights/us-functional-beverage-market-insights.