As we step into October, the latest numbers show that international visits to the United States are still under pressure. August data revealed overseas arrivals were nearly three percent lower than a year earlier. Los Angeles reported an eight percent decline across the summer months while Las Vegas saw an 11% fall in June with hotel occupancy down 15%.

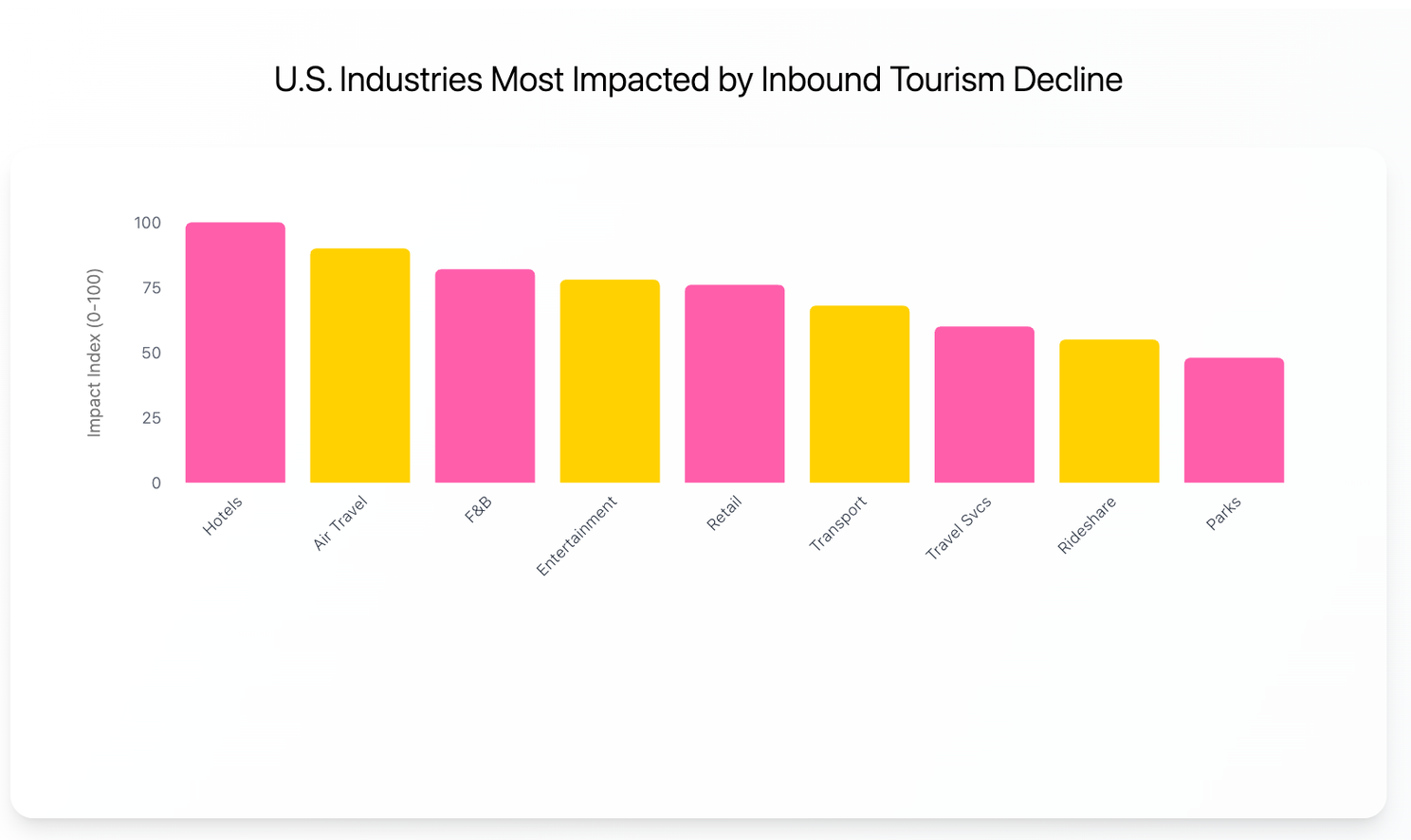

This drop matters because inbound visitors typically spend more than domestic tourists. They book longer hotel stays, eat in restaurants more often, and are bigger buyers of luxury goods. Fewer arrivals mean weaker demand across hotels, airlines, restaurants, retail, attractions, and even local transport services.

Policy friction is adding to the challenge. A new $250 visa fee is set to take effect in October for travelers from countries like India, China, and Mexico. Wait times for visa appointments remain long. At the same time, federal cuts to Brand USA reduce the ability to promote U.S. destinations abroad. Competing markets are investing in marketing while the United States is scaling back.

The financial risks are large. The World Travel and Tourism Council forecasts that the U.S. will lose more than $12 billion in international visitor spending this year compared to 2024. Cities that depend on hotel tax revenue will feel the pain. Luxury retailers and cultural attractions will have fewer high-spending customers. Entertainment venues from Broadway theaters to Las Vegas shows will need discounts and promotions to fill seats.

Unless visa policies ease and promotion efforts expand, inbound tourism is unlikely to rebound in the near term. October begins with uncertainty for an industry that has historically been one of America’s most reliable growth engines.